Our Performance (Environment) Working Group, which comprises 29 members from different functions within the Company, has developed key performance indicators for seven environmental and resource management focus areas.

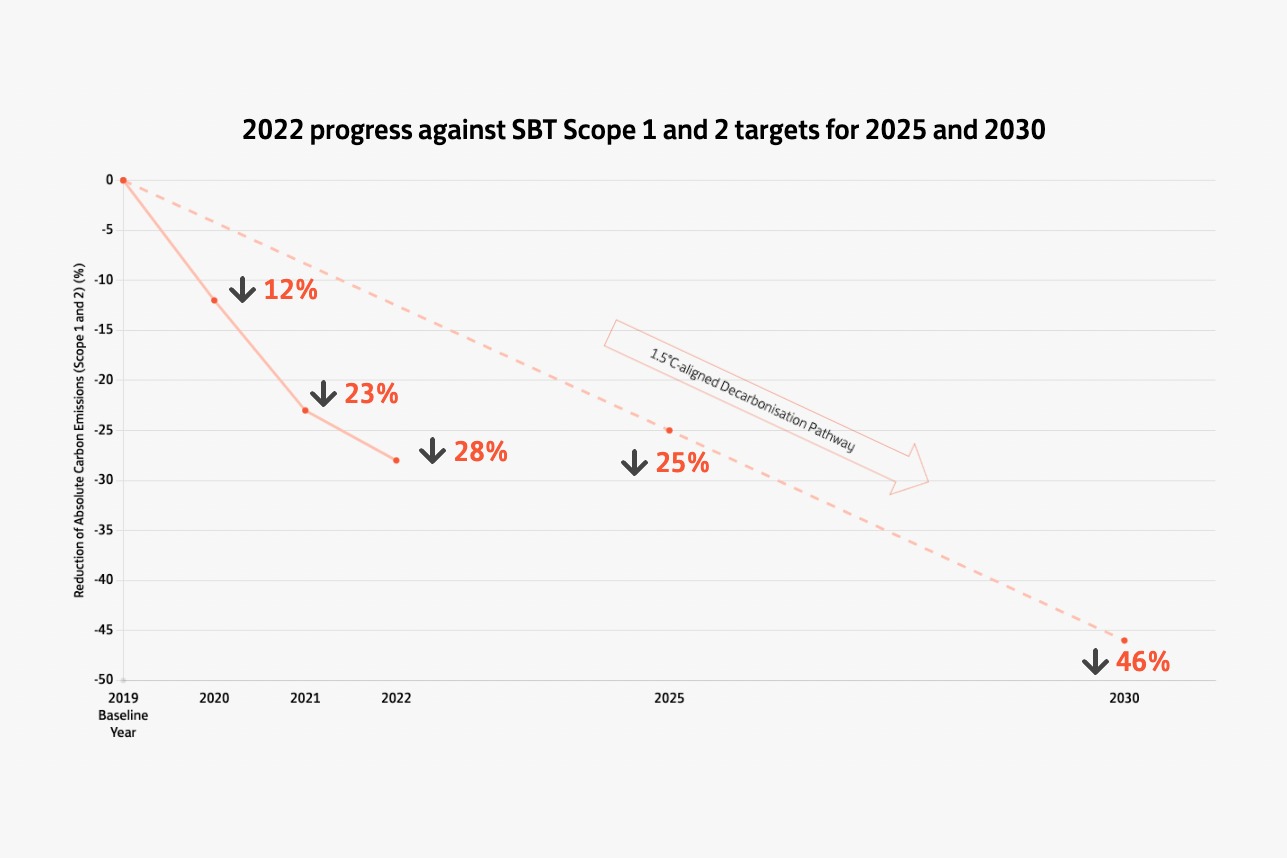

This year, we continued to work towards our 2025 and 2030 KPIs, with our approved 1.5°C science-based targets guiding our efforts across the Company. Our 2022 progress is summarised in the table below.

Decarbonisation

2025 KPI

- Operational Carbon Emissions (Scope 1 and 2 SBT): Reduce absolute greenhouse gas (“GHG”) emissions by 25%14

Progress Updates in 2022

- Reduction of Scope 1 and 2 absolute GHG emissions:

28%

2030 KPI

- Value Chain GHG Emissions (Scope 3 SBT – Downstream Leased Assets): Reduce carbon intensity from the tenant-controlled portion of downstream leased assets by 28% per square metre15

- Value Chain GHG Emissions (Scope 3 SBT – Capital Goods): Reduce embodied carbon intensity from new development projects by 25% per square metre (construction floor area)16

Progress Updates in 2022

- Reduction of carbon intensity from the tenant-controlled portion of downstream leased assets:

40%

- Reduction of embodied carbon intensity from new major developments:

17%

Energy Reduction

2025 KPI

- Reduction of electricity use intensity (kWh/m2)17:

Hong Kong portfolio18

20%

Chinese Mainland portfolio20

13%

Progress Updates in 2022

- Reduction of electricity use intensity (kWh/m2):

Hong Kong portfolio

15%

Chinese Mainland portfolio

9%

- Continued to implement energy-saving measures throughout our Hong Kong and Chinese Mainland portfolios and hotels.

Renewable Energy

2025 KPI

- Generate 4-6% of landlord’s building energy from on-site renewable or clean energy sources for selected newly completed office projects

Progress Updates in 2022

- Approximately 6% of landlord’s building energy will be supplied by renewable sources at Two Taikoo Place.

- 100% of electricity at Sino-Ocean Taikoo Li Chengdu and The Temple House in Chengdu, as well as Taikoo Hui Guangzhou is procured from renewable sources.

Resource Recycling and Waste Diversion

2025 KPI

Waste diversion rates from landfills:

- Hong Kong portfolio (including hotels)

30% of commercial waste - Hong Kong (projects under development)

85% of demolition waste

70% of construction waste - Chinese Mainland (projects under development)

50% of total waste21

Waste recycling rate:

- Chinese Mainland portfolio (including hotels)

40% of commercial waste

Progress Updates in 2022

Waste diversion rates from landfills:

- Hong Kong portfolio (including hotels)

25.4% of commercial waste - Hong Kong (projects under development)

94.6% of demolition waste for 6 Deep Water Bay Road

81.7% of construction waste for EIGHT STAR STREET

89.3% of construction waste for Two Taikoo Place

- Chinese Mainland (projects under development)

84.5% of construction waste for Taikoo Li Qiantan

60.3% of construction waste for Taikoo Li Sanlitun West extension

Waste recycling rate:

- Chinese Mainland portfolio (including hotels)

44.8% of commercial waste

Water Reduction

2025 KPI

- Reduction of water intensity:

Hong Kong portfolio22 (m3/m2)

10%

Chinese Mainland portfolio22 (m3/m2)

20%

Hotels23 (m3/guest night)

8%

Progress Updates in 2022

- Reduction of water intensity:

Hong Kong portfolio (m3/m2)

9.2%

Chinese Mainland portfolio (m3/m2)

25.9%

Hotels (m3/guest night)

15.1%

Integration

2025 KPI

- Conduct biodiversity surveys in 50% of new development projects

- Implement guidelines to integrate biodiversity considerations into new developments

Progress Updates in 2022

- The findings and recommendations from the completed urban biodiversity study of our Taikoo Place redevelopment have been discussed and shared with various departments to enhance the biodiversity of both existing projects and projects under development. The findings from the study will be used to establish guidelines to integrate biodiversity considerations in future new projects.

Indoor Air Quality (“IAQ”) Management

2025 KPI

- For common areas, 90% of buildings achieve IAQ Excellent Class in our Hong Kong portfolio24 or fulfil the local IAQ standard in our Chinese Mainland portfolio25

Progress Updates in 2022

- For common areas, approximately 83% of buildings in our Hong Kong portfolio achieved IAQ Excellent Class.

- Approximately 80% of buildings in our Chinese Mainland portfolio fulfilled the local IAQ standard.

Environmental Building Assessment Schemes26

2025 KPI

- 100% of wholly-owned new development projects27 to achieve the highest environmental building assessment scheme rating

- 90% of all wholly-owned existing developments27 to achieve the highest environmental building assessment scheme rating

Progress Updates in 2022

- 100% of projects under development achieved the highest ratings.

- 93% of wholly-owned existing developments achieved the highest ratings.

Hong Kong portfolio

- Lincoln House achieved Final Platinum rating under BEAM Plus Existing Building Version 2.0.

- Pacific Place achieved Final Platinum rating under BEAM Plus Existing Building Version 2.0.

Chinese Mainland portfolio

- Taikoo Hui Guangzhou achieved Platinum under LEED v4 for Building Operations and Maintenance: Existing Buildings and Platinum under WELL Version 2 Core.

- Taikoo Li Sanlitun achieved Platinum under LEED v4.1 for Building Operations and Maintenance: Existing Buildings.

See More In