Carbon Emissions

GRI 305

HKEX KPI A1.2, A1.5

HKEX KPI A1.2, A1.5

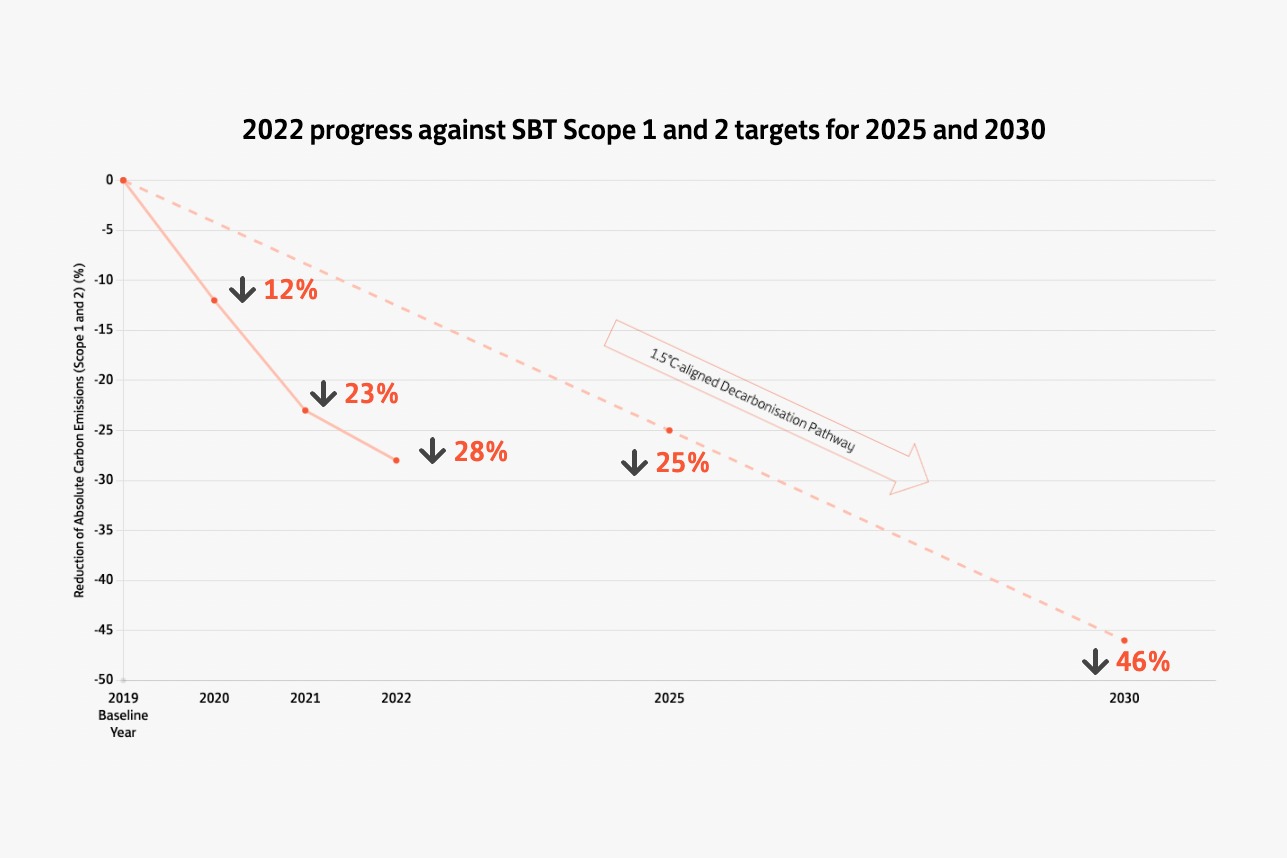

In 2022, our total carbon emissions (Scope 1 and 2) decreased by 6% compared to 2021. The carbon intensity in our Hong Kong portfolio, Chinese Mainland portfolio and U.S.A. portfolio decreased compared to 2021.

The Company’s largest source of Scope 2 emissions arising from purchased electricity. This category of emissions decreased by 6% compared to 2021. This is attributed to various initiatives including the adoption of innovative low-carbon technologies, better energy management, and the procurement of renewable electricity at Taikoo Li Sanlitun, although the impacts of COVID-19 also lowered the electricity demand.

For further information about our progress against SBTs and our efforts to reduce our carbon emissions, please click here.

Carbon Emissions – Scope 3

In 2019, Swire Properties developed SBTs which were validated, and approved by SBTi. Aside from our ambitious Scope 1 and 2 emissions target, our SBTs also encompass the significant categories of our upstream and downstream value chain emissions.

We have established science-based targets to reduce the emissions generated by capital goods and downstream leased assets by 25%28 and 28%29 per square metre respectively by 2030.

Swire Properties is conscious of our direct and indirect emissions at various stages along the value chain. Besides measuring Scope 1 (direct carbon emissions mainly from energy combustion on-site) and Scope 2 carbon emissions (indirect carbon emissions which mainly comes from electricity purchased and used), since 2018 we have conducted comprehensive reviews of our Scope 3 emissions (indirect emissions that occur along the value chain) to understand our emissions sources and identify the associated material categories for management and reporting.

Our 2022 review identified that the most significant sources of our Scope 3 emissions come from Category 1 – Purchased Goods and Services, Category 2 – Capital Goods, and Category 13 – Downstream Leased Assets, as categorised by the Greenhouse Gas Protocol, accounts for over 70% of our value chain emissions.

28 | Compared to the 2016-2018 baseline. |

29 | Compared to the 2018 baseline. |

Scope 3 Emissions by Category

Category 1’s contribution to our total scope 3 emissions increased from 15.9% in 2021 to 23.0% in 2022. The increase was mainly attributed to the upfront embodied carbon of procured construction materials and on-site energy use during the construction stage at The River and EIGHT STAR STREET, our latest residential development in Vietnam and Hong Kong. The operational carbon associated with residential building was reported under Category 11 - Use of Sold Products. For further information on the lifecycle carbon emissions of the EIGHT STAR STREET project, please click here.

The disclosure of our Scope 3 emissions is included in this report and presents a more holistic view of the Company’s carbon footprint along the value chain. This data has been included in our SD Report since 2020 – please refer to Performance Data Summary for details. While Swire Properties may have limited influence or control over some of our Scope 3 emissions categories, we will continuously monitor these emissions and seek opportunities to influence, particularly if they begin to represent an increasing portion of our total carbon footprint.

Electricity use intensity

GRI 302

HKEX KPI A2.1, A2.3

HKEX KPI A2.1, A2.3

In 2022, our electricity use intensity30 decreased by 41%, from 194 kWh per square metre (“kWh/m2”) per year to 114 kWh/m2 per year across our global portfolios, as compared to our 2008 baseline year.

In 2022, the electricity use intensity in our Hong Kong portfolio (including hotels) decreased by 15% as compared to our 2019 baseline year.

Electricity use intensity

2025 Target31

2022 Progress

2025 Target31

2022 Progress

2025 Target31

2022 Progress

In 2022, the electricity use intensity in our Chinese Mainland portfolio (including hotels) decreased by 9% as compared to our 2019 baseline year.

Electricity use intensity

2025 Target31

2022 Progress

2025 Target31

2022 Progress

2025 Target31

2022 Progress

30 | Electricity use intensity refers to electricity consumption (per square metre) for the provision of shared services for and in the common parts of our buildings. |

31 | Compared to the 2019 baseline. |

Electricity Use Intensity of Portfolios 2018-2022

Please select the Portfolio:

For further information about our energy reduction initiatives, please click here.

Water Use

GRI 303

HKEX KPI A2.2, A2.4

HKEX KPI A2.2, A2.4

In 2022, the total water usage in all portfolios and hotels decreased by 8% as compared to 2021. On top of our continued efforts on the rollout of water saving initiatives such as the installation of low flow restrictors to optimise water usage across our portfolios, we further identified opportunities to reduce freshwater demand such as using seawater for flushing, greywater recycling and rainwater harvesting. At our Hotels, some of the reduction were, in part, due to the relative decrease in the number of guest nights during the period when COVID-19 pandemic worsened.

When measured against our 2025 KPI, the water intensity of the Hong Kong portfolio decreased by 9.2% in 2022 as compared to the 2016 BAU baseline. In 2022, the reduction was mainly attributed to the switch of seawater supply for freshwater flushing at Citygate and the restoration in seawater supply for flushing at Cityplaza mall.

The water intensity in our Chinese Mainland portfolio decreased by 25.9% compared to the 2016 BAU baseline. In 2022, the reduction was mainly due to the reduced occupancy in offices and footfall in malls.

In our Hotels, the water intensity in 2022 has increased by 15.1% as compared to the 2018/2019 baseline used for our 2025 KPI. We attribute this, in part, to the relative decrease in the number of guest nights during the period when COVID-19 pandemic worsened.

For further information about our water reduction initiatives, please click here.

Water Intensity

2025 Target

2022 Progress

2025 Target

2022 Progress

2025 Target

2022 Progress

2025 Target

2022 Progress

2025 Target

2022 Progress

2025 Target

2022 Progress

2025 Target

2022 Progress

Remarks:

- Our Hong Kong portfolio refers to our office and retail portfolios in Hong Kong, excluding hotels; our Chinese Mainland portfolio refers to our office and retail portfolios in the Chinese Mainland, excluding hotels.

- For our Hong Kong portfolio and Chinese Mainland portfolio, the water intensity reduction targets are compared to a 2016 BAU baseline year.

- For Hotels, the water intensity reduction targets set is compared to a 2018/2019 baseline year.

Materials Used

By Project Under Development in 2022

GRI 301-1

119879m³

Concrete

15372tonnes

Reinforcement bar

2139m³

Timber

5850MWh

Electricity consumption

308593litres

Diesel consumption

71444m³

Water consumption

Remarks:

- Projects under development refers to projects that are under construction or in the pre-certification stage.

- Includes investment properties under development in all portfolios, including joint venture and non-joint venture projects.

- “Diesel consumption” includes biodiesel consumption.

See More In