ISSB Exposure Draft Climate-related Disclosures Content Index

We support the latest international reporting standard to provide consistent, timely and comparable information related to climate-related issues. In 2022, we began mapping our climate disclosures to the recommendations of the International Sustainability Standards Board's (ISSB) Exposure Draft IFRS S2 Climate-related Disclosures.

Scroll down or drag the table horizontally to read more

Disclosure Description | References and Remarks (Unless otherwise specified, references are made to sections of the Sustainable Development Report 2022) |

|---|---|

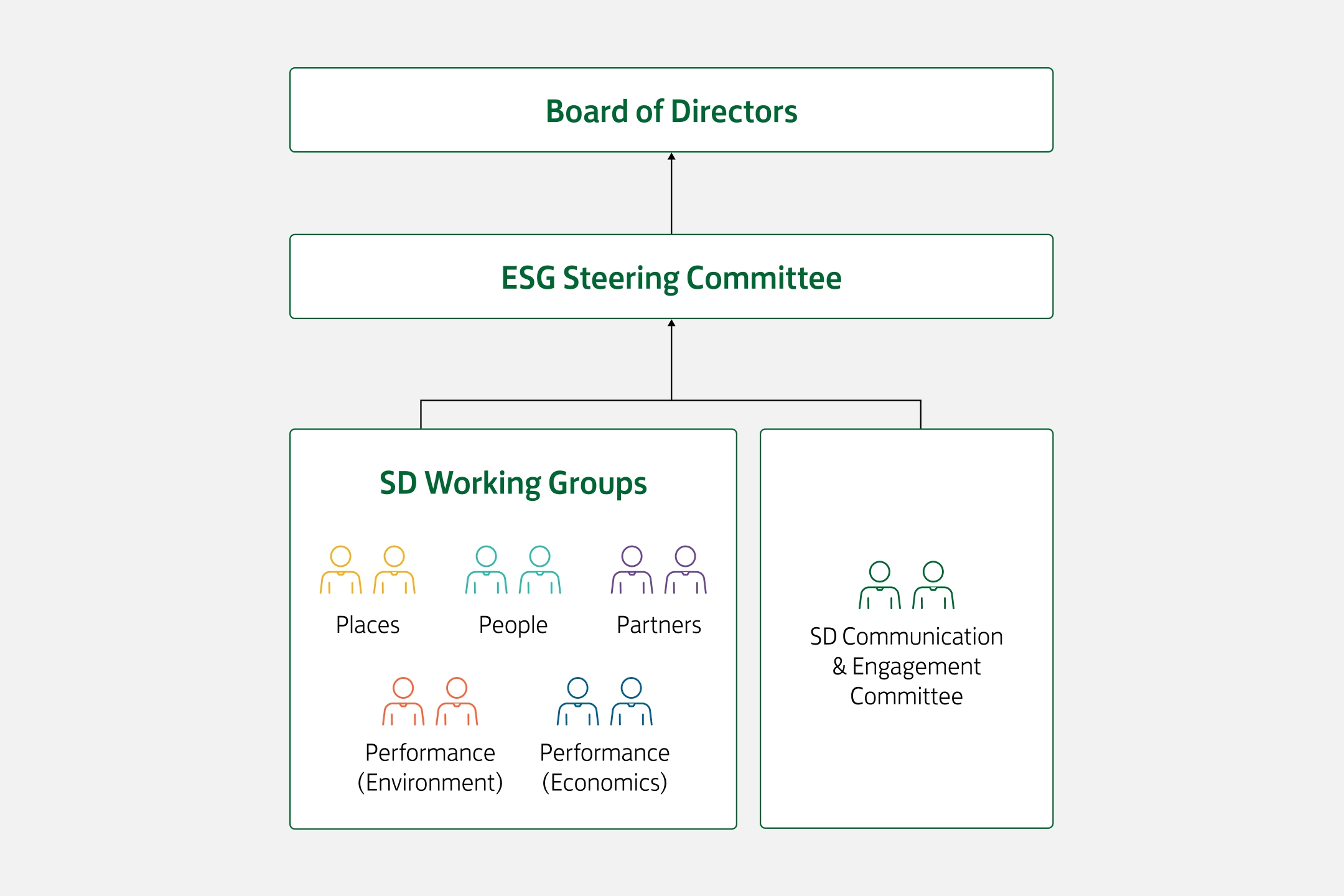

Governance (4) The objective of climate-related financial disclosures on governance is to enable users of general purpose financial reporting to understand the governance processes, controls and procedures used to monitor and manage climate-related risks and opportunities. (5) To achieve this objective, an entity shall disclose information about the governance body or bodies (which can include a board, committee or equivalent body charged with governance) with oversight of climate-related risks and opportunities, and information about management’s role in those processes. | |

5(a) The identity of the body or individual within a body responsible for oversight of climate-related risks and opportunities; | SD Governance Climate-related Financial Disclosures Annual Report 2022 – Corporate Governance |

5(b) how the body’s responsibilities for climate-related risks and opportunities are reflected in the entity’s terms of reference, board mandates and other related policies; | SD Governance Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Corporate Governance Annual Report 2022 – Risk Management Corporate Website – Terms of Reference for Environmental, Social and Governance Steering Committee Corporate Website – Climate Change Policy |

5(c) how the body ensures that the appropriate skills and competencies are available to oversee strategies designed to respond to climate-related risks and opportunities; | Climate-related Financial Disclosures Annual Report 2022 – Corporate Governance |

5(d) how and how often the body and its committees (audit, risk or other committees) are informed about climate-related risks and opportunities; | SD Governance Climate-related Financial Disclosures |

5(e) how the body and its committees consider climate-related risks and opportunities when overseeing the entity’s strategy, its decisions on major transactions, and its risk management policies, including any assessment of trade-offs and analysis of sensitivity to uncertainty that may be required; | SD Governance Climate-related Financial Disclosures Performance (Economic) |

5(f) how the body and its committees oversee the setting of targets related to significant climate-related risks and opportunities, and monitor progress towards them, including whether and how related performance metrics are included in remuneration policies; and | SD Governance Performance (Environment) Climate-related Financial Disclosures Performance (Economic) 2025 and 2030 Targets Corporate Website – Terms of Reference for Environmental, Social and Governance Steering Committee Corporate Website – Terms of Reference for Remuneration Committee Corporate website – Remuneration Policy |

5(g) a description of management’s role in assessing and managing climate-related risks and opportunities, including whether that role is delegated to a specific management-level position or committee and how oversight is exercised over that position or committee. The description shall include information about whether dedicated controls and procedures are applied to management of climate-related risks and opportunities and, if so, how they are integrated with other internal functions. | SD Governance Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Risk Management |

Strategy (7) The objective of climate-related financial disclosures on strategy is to enable users of general purpose financial reporting to understand an entity’s strategy for addressing significant climate-related risks and opportunities. | |

8(a) the significant climate-related risks and opportunities that it reasonably expects could affect its business model, strategy and cash flows, its access to finance and its cost of capital, over the short, medium or long term; | See the reference for paragraph 9 |

8(b) the effects of significant climate-related risks and opportunities on its business model and value chain; | See the reference for paragraph 12 |

8(c) the effects of significant climate-related risks and opportunities on its strategy and decision-making, including its transition plans; | See the reference for paragraph 13 |

8(d) the effects of significant climate-related risks and opportunities on its financial position, financial performance and cash flows for the reporting period, and the anticipated effects over the short, medium and long term—including how climate-related risks and opportunities are included in the entity’s financial planning; and | See the reference for paragraph 14 |

8(e) the climate resilience of its strategy (including its business model) to significant physical risks and significant transition risks. | See the reference for paragraph 15 |

Climate-related risks and opportunities (9) An entity shall disclose information that enables users of general purpose financial reporting to understand the significant climate-related risks and opportunities that could reasonably be expected to affect the entity’s business model, strategy and cash flows, its access to finance and its cost of capital, over the short, medium or long term. | |

9(a) a description of significant climate-related risks and opportunities and the time horizon over which each could reasonably be expected to affect its business model, strategy and cash flows, its access to finance and its cost of capital, over the short, medium or long term. | Performance (Environment) Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Risk Management |

9(b) how it defines short, medium and long term and how these definitions are linked to the entity’s strategic planning horizons and capital allocation plans. | |

9(c) whether the risks identified are physical risks or transition risks. | |

(10) In identifying the significant climate-related risks and opportunities described in paragraph 9(a), an entity shall refer to the disclosure topics defined in the industry disclosure requirements. (11) In preparing disclosures to fulfil the requirements in paragraphs 12–15, an entity shall refer to and consider the applicability of cross-industry metric categories and the industry-based metrics associated with disclosure topics, as described in paragraph 20. | |

12(a) a description of the current and anticipated effects of significant climate-related risks and opportunities on its value chain; and | Partners Performance (Environment) Climate-related Financial Disclosures Performance (Economic) |

12(b) a description of where in its value chain significant climate-related risks and opportunities are concentrated. | |

Strategy and decision-making (13) An entity shall disclose information that enables users of general purpose financial reporting to understand the effects of significant climate-related risks and opportunities on its strategy and decision-making, including its transition plans. | |

13(a) how it is responding to significant climate-related risks and opportunities including how it plans to achieve any climate-related targets it has set. | |

(i) information about current and anticipated changes to its business model, including: | |

(1) about changes the entity is making in strategy and resource allocation to address the risks and opportunities identified in paragraph 12. This information includes plans and critical assumptions for legacy assets, including strategies to manage carbon-energy- and water-intensive operations, and to decommission carbon-energy- and water-intensive assets. | Partners Performance (Environment) Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Key Business Strategies Annual Report 2022 – Risk Management |

(2) information about direct adaptation and mitigation efforts it is undertaking. | |

(3) information about indirect adaptation and mitigation efforts it is undertaking. | Partners Performance (Environment) |

(ii) how these plans will be resourced. | SD Governance Partners Performance (Environment) Climate-related Financial Disclosures Performance (Economic) |

13(b) information regarding climate-related targets for these plans including: | |

(i) the processes in place for review of the targets; | SD Governance Performance (Environment) Climate-related Financial Disclosures 2025 and 2030 Targets |

(ii) the amount of the entity’s emission target to be achieved through emission reductions within the entity’s value chain; | Performance (Environment) Climate-related Financial Disclosures 2025 and 2030 Targets |

(iii) the intended use of carbon offsets in achieving emissions targets. In explaining the intended use of carbon offsets the entity shall disclose information including: (1)the extent to which the targets rely on the use of carbon offsets; (2)whether the offsets will be subject to a third-party offset verification or certification scheme (certified carbon offset), and if so, which scheme, or schemes; (3)the type of carbon offset, including whether the offset will be nature-based or based on technological carbon removals and whether the amount intended to be achieved is through carbon removal or emission avoidance; and (4)any other significant factors necessary for users to understand the credibility and integrity of offsets intended to be used by the entity. | SD Governance Performance (Environment) Climate-related Financial Disclosures Corporate Website – Climate Change Policy |

13(c) quantitative and qualitative information about the progress of plans disclosed in prior reporting periods in accordance with paragraph 13(a) – (b). | Partners Performance (Environment) |

Financial position, financial performance and cash flows (14) An entity shall disclose information that enables users of general purpose financial reporting to understand the effects of significant climate-related risks and opportunities on its financial position, financial performance and cash flows for the reporting period, and the anticipated effects over the short, medium and long term—including how climate-related risks and opportunities are included in the entity’s financial planning. An entity shall disclose quantitative information unless it is unable to do so. If an entity is unable to provide quantitative information, it shall provide qualitative information. When providing quantitative information, an entity can disclose single amounts or a range. | |

14(a) how significant climate-related risks and opportunities have affected its most recently reported financial position, financial performance and cash flows; | Climate-related Financial Disclosures Performance (Economic) |

14(b) information about the climate-related risks and opportunities identified in paragraph 14(a) for which there is a significant risk that there will be a material adjustment to the carrying amounts of assets and liabilities reported in the financial statements within the next financial year; | Climate-related Financial Disclosures Performance (Economic) |

14(c) how it expects its financial position to change over time, given its strategy to address significant climate-related risks and opportunities, reflecting: (i)its current and committed investment plans and their anticipated effects on its financial position; (ii)its planned sources of funding to implement its strategy; | Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Key Business Strategies Annual Report 2022 – Management Discussion & Analysis |

14(d) how it expects its financial performance to change over time, given its strategy to address significant climate-related risks and opportunities. | Climate-related Financial Disclosures |

Climate resilience (15) An entity shall disclose information that enables users of general purpose financial reporting to understand the resilience of the entity’s strategy (including its business model) to climate-related changes, developments or uncertainties—taking into consideration an entity’s identified significant climate-related risks and opportunities and related uncertainties. The entity shall use climate-related scenario analysis to assess its climate resilience unless it is unable to do so. If an entity is unable to use climate-related scenario analysis, it shall use an alternative method or technique to assess its climate resilience. When providing quantitative information, an entity can disclose single amounts or a range. | |

15(a) the results of the analysis of climate resilience, which shall enable users to understand: | |

(i) the implications, if any, of the entity’s findings for its strategy, including how it would need to respond to the effects identified in paragraph 15(b)(i)(8) or 15(b)(ii)(6); | Performance (Economic) Climate-related Financial Disclosures |

(ii) the significant areas of uncertainty considered in the analysis of climate resilience; | Climate-related Financial Disclosures |

(iii) the entity’s capacity to adjust or adapt its strategy and business model over the short, medium and long term to climate developments in terms of: (1)the availability of, and flexibility in, existing financial resources, including capital, to address climate-related risks, and/or to be redirected to take advantage of climate-related opportunities; (2)the ability to redeploy, repurpose, upgrade or decommission existing assets; and (3)the effect of current or planned investments in climate-related mitigation, adaptation or opportunities for climate resilience. | SD Governance Performance (Environment) Climate-related Financial Disclosures Annual Report 2022 – Management Discussion & Analysis |

15(b) how the analysis has been conducted, including: (i) when climate-related scenario analysis is used: (1)which scenarios were used for the assessment and the sources of the scenarios used; (2)whether the analysis has been conducted by comparing a diverse range of climate-related scenarios; (3)whether the scenarios used are associated with transition risks or increased physical risks; (4)whether the entity has used, among its scenarios, a scenario aligned with the latest international agreement on climate change; (5)an explanation of why the entity has decided that its chosen scenarios are relevant to assessing its resilience to climate-related risks and opportunities; (6)the time horizons used in the analysis; (7)the inputs used in the analysis, including—but not limited to—the scope of risks, the scope of operations covered, and details of the assumptions; and (8)assumptions about the way the transition to a lower-carbon economy will affect the entity, including policy assumptions for the jurisdictions in which the entity operates; assumptions about macroeconomic trends; energy usage and mix; and technology. | Climate-related Financial Disclosures |

Risk management (16) The objective of climate-related financial disclosures on risk management is to enable users of general purpose financial reporting to understand the process, or processes, by which climate-related risks and opportunities are identified, assessed and managed. | |

17(a) The process, or processes, it uses to identify climate-related: (i)risks; and (i)opportunities; | SD Governance Climate-related Financial Disclosures Performance (Economic) Annual Report 2022 – Risk Management |

17(b) the process, or processes, it uses to identify climate-related risks for risk management purposes, including when applicable: (i)how it assesses the likelihood and effects associated with such risks (such as the qualitative factors, quantitative thresholds and other criteria used); (ii)how it prioritises climate-related risks relative to other types of risks, including its use of risk-assessment tools; (iii)the input parameters it uses; and (iv)whether it has changed the processes used compared to the prior reporting period; | |

17(c) the process, or processes, it uses to identify, assess and prioritise climate-related opportunities; | |

17(d) the process, or processes, it uses to monitor and manage the climate-related: (i)risks, including related policies; and (ii)opportunities, including related policies; | |

17(e) the extent to which and how the climate-related risk identification, assessment and management process, or processes, are integrated into the entity’s overall risk management process; and | |

17(f) the extent to which and how the climate-related opportunity identification, assessment and management process, or processes, are integrated into the entity’s overall management process. | |

Metrics and targets (19) The objective of climate-related financial disclosures on metrics and targets is to enable users of general purpose financial reporting to understand how an entity measures, monitors and manages its significant climate-related risks and opportunities. These disclosures shall enable users to understand how the entity assesses its performance, including progress towards the targets it has set. | |

20(a) information relevant to the cross-industry metric categories, which are relevant to entities regardless of industry and business model; | See the reference for paragraph 21 |

20(b) industry-based metrics which are associated with disclosure topics and relevant to entities that participate within an industry, or whose business models and underlying activities share common features with those of the industry; | See the reference for paragraph 21 |

20(c) other metrics used by the board or management to measure progress towards the targets identified in paragraph 9(d); and | See the reference for paragraph 21 |

20(d) targets set by the entity to mitigate or adapt to climate-related risks or maximise climate-related opportunities. | See the reference for paragraph 23 |

(21) An entity shall disclose information relevant to the cross-industry metric categories of: | |

21(a) greenhouse gas emissions - the entity shall disclose: | |

(i) its absolute gross greenhouse gas emissions generated during the reporting period, measured in accordance with the Greenhouse Gas Protocol Corporate Standard, expressed as metric tonnes of CO2 equivalent, classified as: (1)Scope 1 emissions; (2)Scope 2 emissions; (3)Scope 3 emissions; | Performance (Environment) ESG Reporting Standards and Principles Performance Data Summary |

(ii) its greenhouse gas emissions intensity for each scope in paragraph 21(a)(i)(1)–(3), expressed as metric tonnes of CO2 equivalent per unit of physical or economic output; | |

(iii) for Scope 1 and Scope 2 emissions disclosed in accordance with paragraph 21(a)(i)(1)–(2), the entity shall disclose emissions separately for: (1)the consolidated accounting group (the parent and its subsidiaries); (2)associates, joint ventures, unconsolidated subsidiaries or affiliates not included in paragraph 21(a)(iii)(1); | |

(iv) the approach it used to include emissions for the entities included in paragraph 21(a)(iii)(2); | |

(v) the reason, or reasons, for the entity’s choice of approach in paragraph 21(a)(iv) and how that relates to the disclosure objective in paragraph 19; | |

(vi) for Scope 3 emissions disclosed in accordance with paragraph 21(a)(i)(3): (1)an entity shall include upstream and downstream emissions in its measure of Scope 3 emissions; (2)an entity shall disclose the categories included within its measure of Scope 3 emissions, to enable users of general purpose financial reporting to understand which Scope 3 emissions have been included in, or excluded from, those reported; (3)when the entity’s measure of Scope 3 emissions includes information provided by entities in its value chain, it shall explain the basis for that measurement; (4)if the entity excludes those greenhouse gas emissions in paragraph 21(a)(vi)(3), it shall state the reason for omitting them; | |

21(b) transition risks—the amount and percentage of assets or business activities vulnerable to transition risks; | Climate-related Financial Disclosures |

21(c) physical risks—the amount and percentage of assets or business activities vulnerable to physical risks; | Climate-related Financial Disclosures |

21(d) climate-related opportunities—the amount and percentage of assets or business activities aligned with climate-related opportunities; | Climate-related Financial Disclosures |

21(e) capital deployment—the amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities; | SD Governance Climate-related Financial Disclosures Performance (Economic) |

21(f) internal carbon prices: (i)the price for each metric tonne of greenhouse gas emissions that the entity uses to assess the costs of its emissions; (ii)an explanation of how the entity is applying the carbon price in decision-making; | SD Governance Climate-related Financial Disclosures |

21(g) remuneration: (i)the percentage of executive management remuneration recognised in the current period that is linked to climate-related considerations; and (ii)a description of how climate-related considerations are factored into executive remuneration. | SD Governance Performance (Economic) Annual Report 2022 – Corporate Governance – Remuneration Committee Corporate Website – Terms of Reference for Remuneration Committee Corporate website – Remuneration Policy |

(23) An entity shall disclose its climate-related targets. | |

23(a) metrics used to assess progress towards reaching the target and achieving its strategic goals; | Partners Performance (Environment) Climate-related Financial Disclosures Performance (Economic) 2025 and 2030 Targets Performance Data Summary Assurance Report |

23(b) the specific target the entity has set for addressing climate-related risks and opportunities; | |

23(c) whether this target is an absolute target or an intensity target; | |

23(d) the objective of the target; | |

23(e) how the target compares with those created in the latest international agreement on climate change and whether it has been validated by a third party; | |

23(f) whether the target was derived using a sectoral decarbonisation approach; | |

23(g) the period over which the target applies; | |

23(h) the base period from which progress is measured; and | |

23(i) any milestones or interim targets. | |

See More In