Materiality

HKEX Mandatory Disclosure Requirement, Aspect B8

Materiality

HKEX Mandatory Disclosure Requirement, Aspect B8

We believe that balancing internal and external viewpoints is critical to defining and managing SD issues that are significant to our business and our stakeholders.

Our Stakeholder Engagement Approach

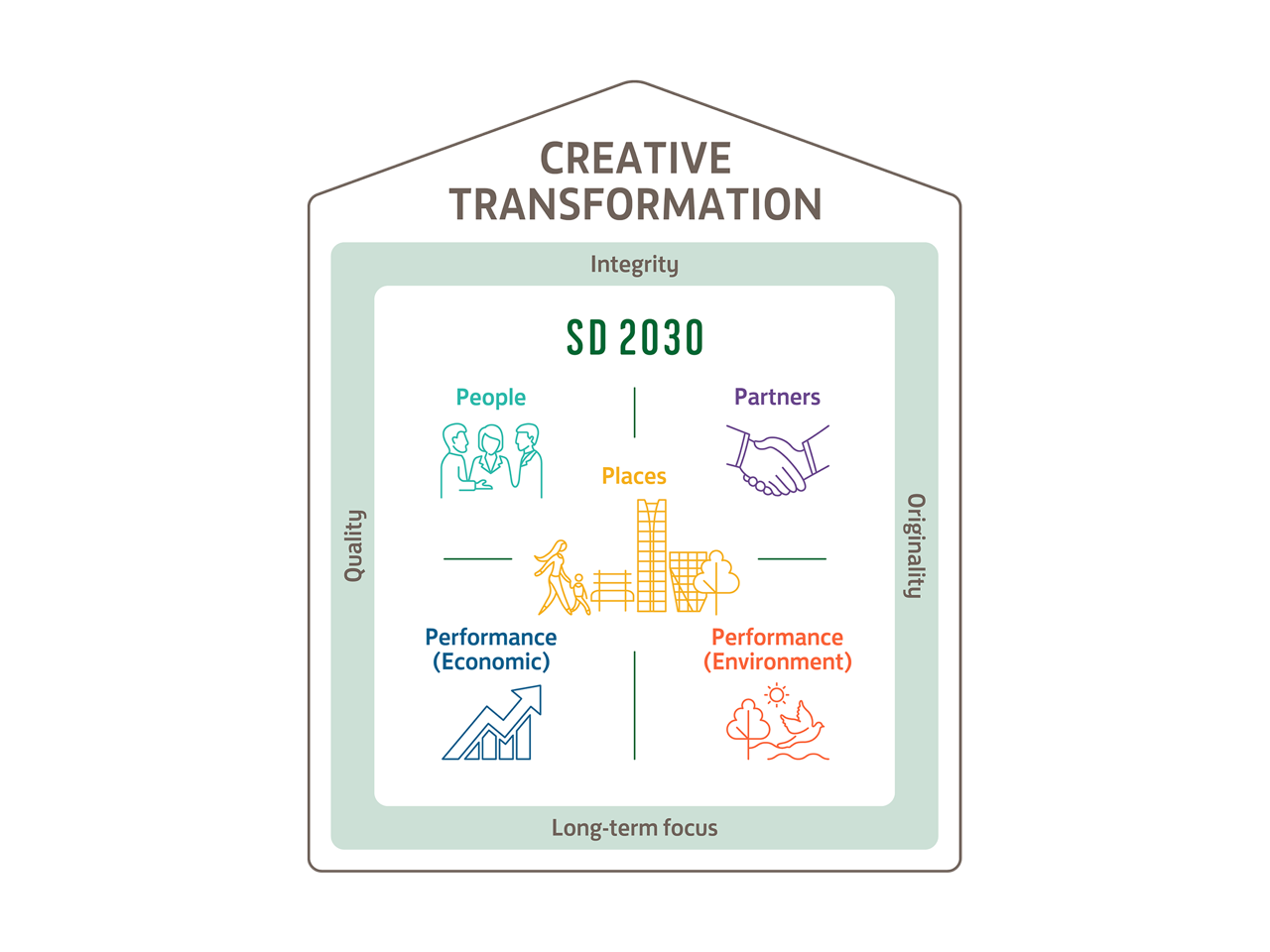

As set out in our SD 2030 Strategy, communication and engagement with employees, investors, tenants, customers, suppliers, regulators, NGOs, community representatives and our many other stakeholders is an integral part of Swire Properties’ daily operations.

We regularly engage with our stakeholders to understand their priorities, expectations and perceptions regarding SD issues. When we first introduced our SD 2030 Strategy in 2016, we engaged extensively with senior managers and employees from across the business and consulted external sustainability experts. Our SD Communication and Engagement Committee continues to gather the support of our employees and other stakeholders to further integrate SD 2030 across our business.

In the past we measured the materiality of a particular issue based on the level of importance to stakeholders. This was based on feedback from external stakeholders, and the importance to our business continuity and development as reflected by feedback from internal stakeholders. In 2023, we embraced double materiality, taking into consideration the issues’ impacts on the organisation (internal materiality) and the organisation’s impact on these issues (external materiality). This approach considers the interconnectedness between our business activities, stakeholder expectations and the environment. It enables us to identify and prioritise material issues that may have significant consequences for our stakeholders, while also aligning with long-term sustainability goals and addressing systemic risks.

Embracing this more robust and data-driven approach to materiality will strengthen our ability to proactively manage risks, seize opportunities and foster sustainable practices that contribute to the wellbeing of our stakeholders, our organisation and the world at large.

The development of this double materiality approach is discussed in the “Our Evolving Approach to Stakeholder-driven Materiality” section below.

Our Stakeholders

GRI 102-40, 102-42, 102-43

Swire Properties’ stakeholders comprise internal and external interest groups that have a significant impact on our business, or that experience significant impacts from our operations. We regularly engage with these stakeholders through the appropriate channels. While the stakeholder groups remained the same in 2024, the number of stakeholders increased.

Stakeholder Groups and Methods of Engagement

Employee Groups

Community / NGOs

Tenants

Customers / Consumers

Suppliers

Regulators / Government

Industry Experts / Academia

Joint Venture Partners

Shareholders and Investors

Media

Our Evolving Approach to Stakeholder-driven Materiality

GRI 3-1, 3-2

HKEX Mandatory Disclosure Requirement

HKEX Mandatory Disclosure Requirement

In 2020, we initiated a materiality review to understand our stakeholders’ perceptions regarding the progress of our SD 2030 Strategy and their evolving expectations and priorities for the future. These perceptions helped further align our business practices, improved our decision-making and accountability, and guided the refinement of our strategy and focus areas in response to the latest local, regional and global developments.

In 2021, we continued this process, adopting a combined qualitative and quantitative approach to assessing materiality. Throughout the COVID-19 pandemic, we gathered stakeholders’ feedback to gain greater understanding of the pandemic’s effects on their businesses, the real estate industry and our operations. The findings provided insights into ways of providing support to our stakeholders during challenging times.

In 2023, to gain a deeper understanding of what aspects are important to the Company’s business continuity and development, and to remain in line with Corporate Sustainability Reporting requirements, we began conducting a new materiality assessment and stakeholder engagement exercise based on the concept of “double materiality”. Proposed by the European Commission’s Guidelines on Reporting Climate-related Information, double materiality encourages a company to assess materiality based on a topic’s implications for the company’s financial performance (financial materiality); on communities and the environment (impact materiality); and the interconnectivity between the two. This “financial-and-impact-based” double materiality will allow us to better assess the integration of sustainability within our business, understand our sustainability impact and align with global best practices in reporting.

Amongst the 590+ responses received, 90% of our surveyed stakeholders perceive Swire Properties as a leader in sustainability. Both internal and external stakeholders recognise decarbonisation, occupational health and safety, and climate adaptation and resilience as issues with significant impacts on the Company, environment and society. Furthermore, there has also been a growth in the recognition of the importance of biodiversity during the time since the last materiality assessment and stakeholder engagement.

Swire Properties is continuing to build on and refine our approach to materiality. In 2023, we undertook a revamped and in-depth materiality assessment and stakeholder engagement exercise based on the concept of double materiality. Led by an independent consultant, the five-phase, mixed-method project aimed to deliver a broad and deep range of insights. For full details on the phases and methodology, please refer to our Sustainability Report 2023.

Double Materiality Matrix

Please select (single option):

Tier 1 Issues

(the most important material issues with the highest potential impact on business success)

Tier 2 Issues

(important material issues with a high potential impact on business success)

Tier 3 Issues

(relatively less important material issues, as perceived by stakeholders, that can impact business success)

Click on the Materiality Matrix to view and learn more about the material issues in each Tier

Tier 1 Issues

(the most important material issues with the highest potential impact on business success)

Tier 2 Issues

(important material issues with a high potential impact on business success)

Tier 3 Issues

(relatively less important material issues, as perceived by stakeholders, that can impact business success)

Places

People

Partners

Performance (Environment)

Performance (Economic)

All Pillars

The top material issues in the matrix are consistent with the focus areas of our SD 2030 Strategy and have been addressed in this report in accordance with the relevant Global Reporting Initiative Standards. The matrix will also inform future reviews of our SD 2030 Strategy, allowing us to continuously drive meaningful impact within the organisation and deliver positive value to our stakeholders.

Discussion of Top Material Issues

Material Issues | Internal Materiality | External Materiality |

|---|---|---|

Green Building | Implementing green building strategies can lead to operational cost savings through reduced energy and water consumption and lower waste management expenses. Green buildings can generate financial opportunities by attracting high-quality tenants that prioritise ESG matters. Investing in green building initiatives allows us to comply with evolving environmental regulations and standards, ensuring long-term compliance and reducing the risk of sanctions or legal issues. | Stakeholders, including tenants and investors, are becoming increasingly committed to decarbonisation and usually have their own decarbonisation targets in place. This has created a positive demand for real estate solutions from like-minded companies that can help them achieve their targets. Green building practices and certifications, such as LEED, are crucial to external stakeholders as they demonstrate a commitment to sustainability. |

Climate | Swire Properties takes proactive measures to mitigate climate risks and build climate resilience across our portfolios. We incorporate sustainable design features into new developments, employ adaptive measures for extreme weather events, and implement disaster preparedness plans. We believe this can enhance climate resilience, minimise potential disruptions, improve occupant safety and wellbeing, and safeguard assets. | Our stakeholders, including tenants, investors and the community, are concerned about climate resilience as they recognise the increasing risks associated with climate change such as extreme weather events, rising sea levels and extreme temperature events. Stakeholders value efforts to enhance infrastructure resilience and adopt adaptive measures to ensure business continuity in the face of climate-related challenges. |

Energy Efficiency | Swire Properties strives to reduce energy consumption in all our portfolios. We invest in best-in-class energy efficiency, perform retro-commissioning and technical upgrades across our portfolios, extensively apply innovative low-carbon and energy-efficient technologies, and are increasing our adoption of renewable energy. Energy efficiency efforts are crucial to delivering on our near-term 1.5°C-aligned science-based targets and transitioning to net-zero before 2050. | Energy efficient operations bring environmental and economic benefits. Stakeholders, including tenants, regulators, and environmental groups, expect organisations to reduce energy consumption and greenhouse gas emissions. Energy efficient buildings contribute to mitigating climate change, help lower operational costs and enhance overall sustainability performance. |

Decarbonisation | Swire Properties was the first real estate company in Hong Kong and the Chinese Mainland to support the Business Ambition for 1.5°C campaign and set ambitious 1.5°C-aligned science-based targets to fight climate change. We have committed to achieving net-zero emissions by 2050 and support Hong Kong’s carbon neutrality pledge. The transition to net-zero will bring us closer to this commitment by saving costs through energy efficiency improvements and by providing opportunities for innovation and market differentiation. Through proactively addressing decarbonisation, we can future-proof our operations, mitigate regulatory risks and position ourselves as an industry leader in sustainable development. | Investors and regulatory bodies are increasingly concerned about organisations’ carbon footprints. Companies are expected to actively reduce greenhouse gas emissions and transition to low-carbon practices in line with the Paris Agreement. Exploring technological innovations, digitalisation, deploying energy-efficient technologies, and increasing renewable energy adoption are crucial if organisations are to align with global climate goals and demonstrate environmental leadership. |

Occupational Health & Safety | Health and safety is an indispensable part of our business. We are committed to providing and maintaining a healthy and safe environment for all our employees, customers, contractors and members of the community during their association with the Company. Occupational health and safety directly impact the wellbeing of employees and the overall productivity and reputation of the Company. Prioritising a safe and healthy work environment helps minimise accidents, injuries and potential liabilities. It also fosters employee satisfaction, engagement and retention, leading to higher productivity and reduced turnover costs. | Employees, local communities, business partners and regulatory bodies consider occupational health and safety to be important. They expect organisations to prioritise the wellbeing of their employees and those with whom they work by providing safe working conditions. Demonstrating a strong commitment to occupational health and safety protects employees, enhances an organisation’s reputation, attracts and retains talent, and reduces the risk of legal and reputational issues. It is a fundamental aspect of responsible and sustainable business practices. |

List of Material Issues

Level of importance increased compared to the previous stakeholder engagement exercise

Level of importance decreased compared to the previous stakeholder engagement exercise

Level of importance remained broadly the same compared to the previous stakeholder engagement exercise

Level of likelihood that the material issue will become increasingly important in the future

SEE MORE IN